Psychological pricing.

Ask most retailers what it is, and they’ll usually say that it’s pricing a product at $49.99 rather than $50.

But that’s only one manifestation of psychological pricing. Not limited to just one tactic, psychological pricing is an entire pricing strategy that seeks to leverage consumer psychology to set a product’s prices.

This pricing strategy can play a big part in your company’s revenue — even if you’re not consciously using it.

Leverage it correctly, and you’ll be able to nudge your customers into choosing the products you want them to buy (like your bestsellers, high-margin items, excess inventory, etc.) without them ever suspecting your gentle, calculated push.

So what’s the secret to using psychological pricing to capture customers and drive sales? And is it actually the best strategy for your brand?

That’s exactly what we’ll cover in this guide.

We’ll show you what psychological pricing is, then dive into all the pros and cons of using it. You’ll then find a rundown of the seven most popular psychological pricing strategies used by top businesses.

What is Psychological Pricing?

Should You Use a Psychological Pricing Strategy?

The Advantages of a Psychological Pricing Strategy

The Disadvantages of Psychological Pricing

The Top 7 Psychological Pricing Strategies to Test in eCommerce

Start Testing These Psychological Pricing Strategies Today

But before you can determine which pricing strategies are best for your brand, let’s start with the fundamentals.

What is Psychological Pricing?

Psychological pricing is a pricing strategy that uses consumer psychology to influence customer’s perceived value of your products.

These tactics subtly encourage consumers to take action and make a purchase.

An example of psychological pricing is when something’s priced at $9.99 instead of $10. Though this one-cent difference won’t make or break your revenue, it can motivate more customers to convert (and we’ll discuss why it works later).

However, your marketing and sales go hand-in-hand with psychological pricing. And sometimes, how you sell to your audience matters more than what your products cost.

So for today’s purposes, we’ll focus our time on psychological pricing strategies and how they impact consumer behavior. We’ll save the sales and marketing aspects for another article.

Now let’s address all the upsides and downsides of using psychological pricing in your business.

Should You Use a Psychological Pricing Strategy?

Using a psychological pricing strategy isn’t a panacea for fixing conversion rates or plugging holes in your funnel.

That only happens if the other pieces of the puzzle – your product, brand equity, segmentation, messaging, marketing, etc. – are also in line. So while psychological pricing is worth your attention, it’s not going to fix all your problems if you have issues in those areas.

The impact of psychological pricing strategies differs based on your industry, the types of products you sell, how often you use them, your target buyers, and many other variables.

In a nutshell: you can’t expect any pricing strategy to do the heavy lifting for you.

On the plus side, there are more pros than cons to using psychological pricing in your company, as you’ll see next.

The Advantages of a Psychological Pricing Strategy

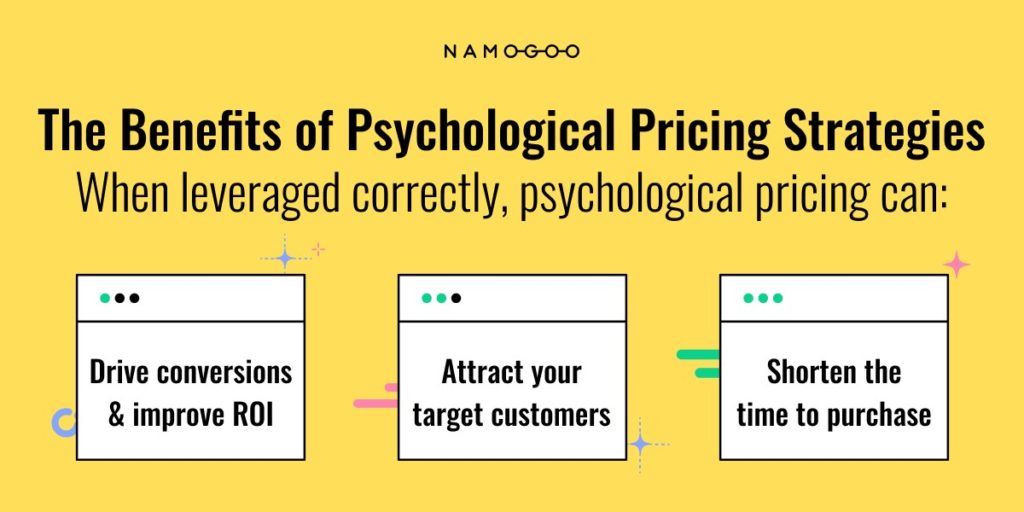

Here are the three biggest reasons to use psychological pricing strategies:

- You’ll drive sales and improve ROI. Because they’re based on psychological principles, once you understand how to motivate customers to buy from your brand, you’ll see higher conversions and more sales as a result (when done correctly, of course).

- Psychological pricing captures attention. These strategies help your products stand out and get noticed by consumers. More eyes on your products translates to more potential sales. So once you pique your customers’ interest, you just have to highlight your product’s features to snag the conversion.

- It may shorten the time to purchase. Psychological pricing strategies show customers right away whether your brand can solve their needs for the price they’re willing to pay. They’ll spend less time shopping around and convert more quickly.

Despite these benefits, there are some downsides to consider with these popular pricing tactics too.

The Disadvantages of Psychological Pricing

Your business must strike the right balance when using psychological pricing strategies because:

- Successfully leveraging psychological pricing requires a strong handle on the psychology of your buyer personas and customers. Because the psychological pricing strategies that work vary depending on the brand equity, product offerings, and target customers of each company, no one tactic will be a guaranteed success. Leveraging charm pricing could sabotage conversions for one brand but transform another brand’s conversion funnel.

Testing psychological pricing is not as simple as testing sending users to an ajax cart vs. a cart page, for example. It can be a heavy lift to perform a pricing test, and realistically you only have one shot to test it before your customers notice pricing inconsistencies. - Overusing these strategies may dilute your customer perceived value (CPV), or how worthy your customers think your brand is of their hard-earned money.

Lowering your CPV by using too many psychological pricing strategies (or ones that don’t make sense for your audience) may cause customers to think less of your brand and its products. It will become more challenging to capture sales (and much more difficult to rebuild your reputation).

Similarly, there’s a fine line between keeping your CPV high but not so high that it turns your target customers away. You don’t want consumers to think your products are out of reach and shop around for other “more attainable” options.

So if you’re constantly trying to pull a fast one on customers with psychological pricing tactics, they’ll see right through them and start to lose trust. Going overboard here or misusing them will backfire.

So now that you know the drawbacks and benefits of psychological pricing, let’s get into:

The Top 7 Psychological Pricing Strategies to Test in eCommerce

Some psychological pricing strategies will work better for your brand than others, since different audiences respond to different pricing tactics.

So check out this rundown of the seven most commonly used pricing strategies to see which may resonate with your target buyers:

1. Charm Pricing

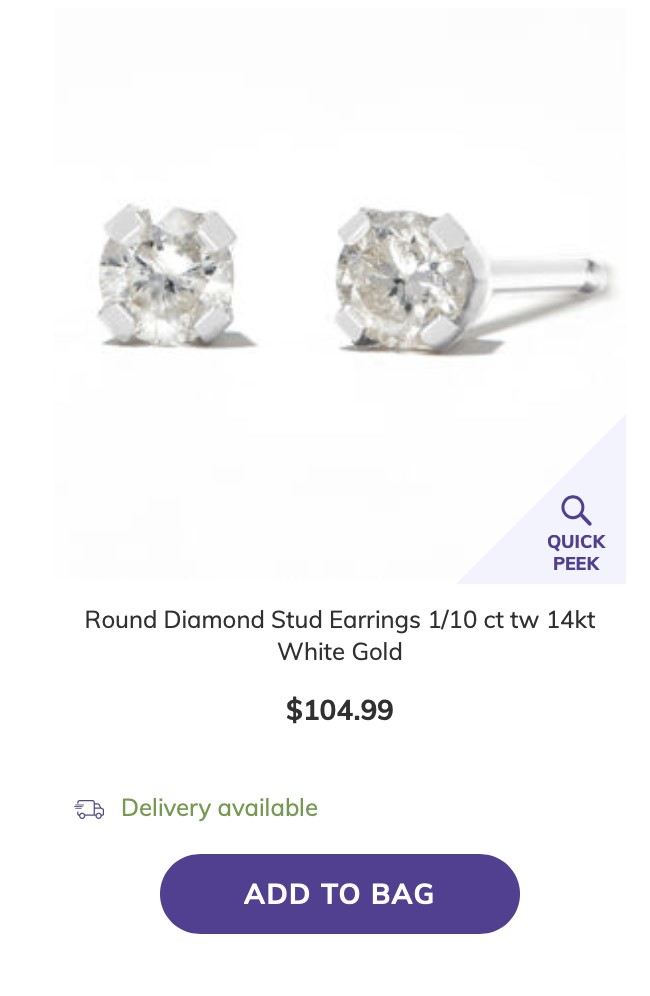

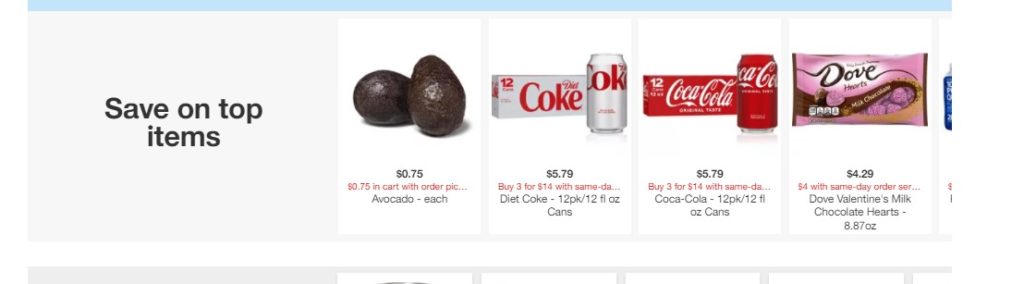

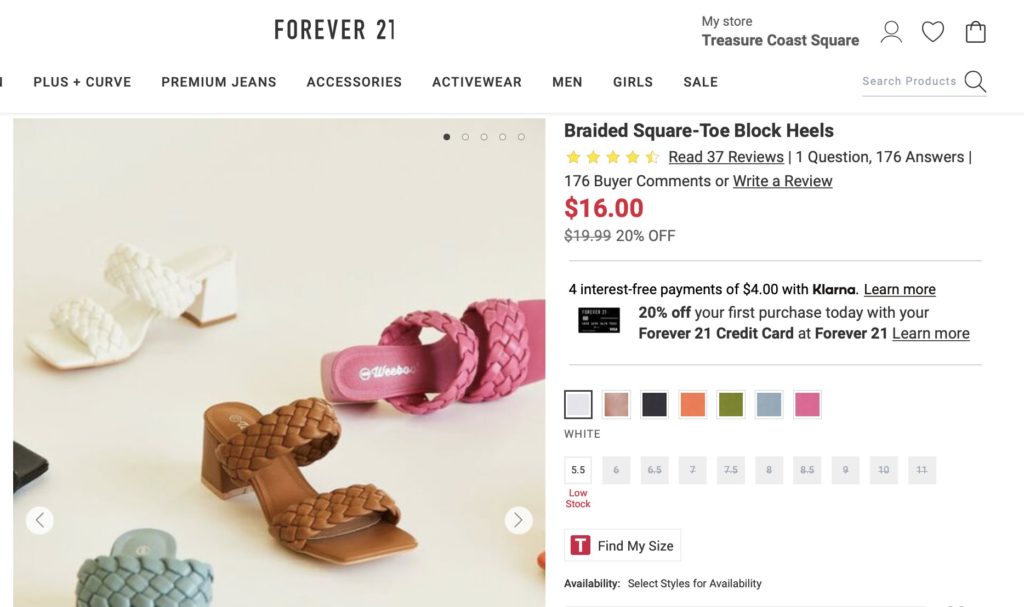

The example mentioned at the beginning of this article is charm pricing in action. Rather than charging $20 for an item, charm pricing lowers that tag to $19.99.

Because we read prices from left to right, when we see a lower number (in this case, $19), it feels closer to a dollar in savings (compared to $20).

Despite this price difference being just a penny less, the lower price looks more enticing in the eyes of consumers. Check out how this looks in the following example:

However, charm pricing has the opposite effect on luxury goods.

Price tags ending in .99 are seen as a cheap deal anyone can get, whereas price endings with .00 seem more luxurious and exclusive.

2. Odd/Even Pricing

Odd/even pricing works because customers subconsciously have a higher price sensitivity and perception of certain price tag endings.

Go for odd price endings when you want customers to feel like they’re scoring a deal. Those .97 prices seem more attractive to price-conscious shoppers and those looking for sales.

Consider AB testing the use of even numbers as sometimes using prices that end in even numbers is a more effective approach.

Here’s what that looks like:

3. Decoy Pricing

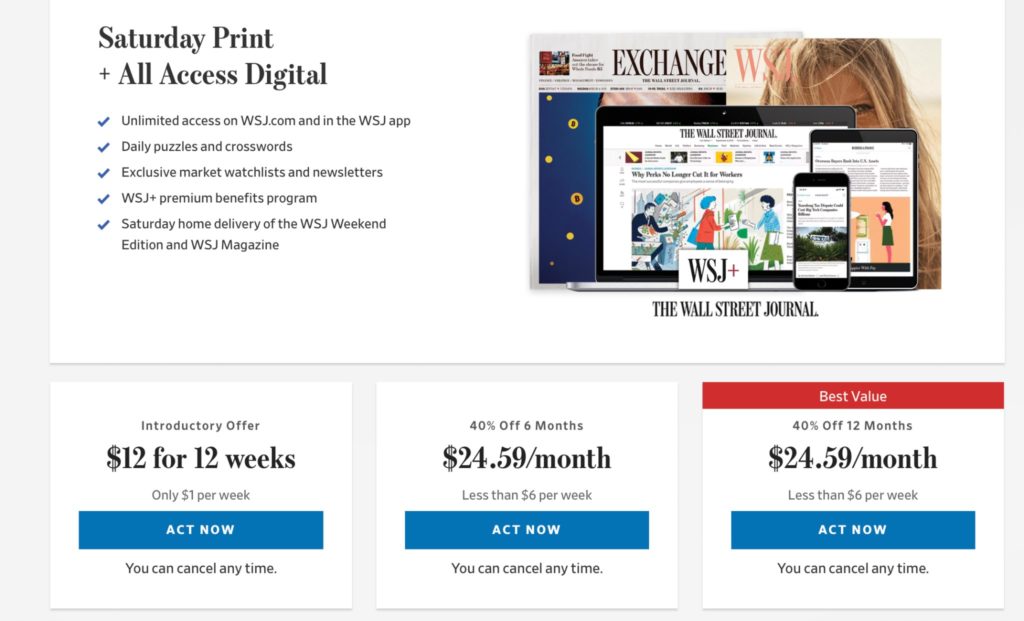

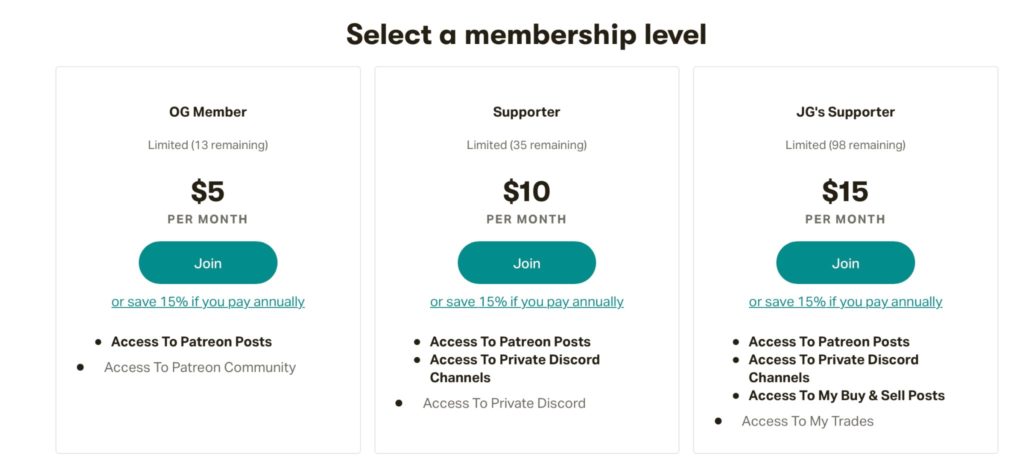

Decoy pricing is a bit more complicated than simply varying your price endings. It’s based on the decoy effect, which states that customers often change their minds when considering two options if a third choice, or decoy, comes into the picture.

The third option is inferior to the other two, making it asymmetrically dominated. This decoy is designed to make one of the other two options look like the better choice.

The goal is not to sell the decoy item, but to use the decoy pricing to steer customers to the product you want them to buy, such as the one that generates a better ROI.

We can see an example of decoy pricing in the famous newspaper study conducted by behavioral economics researcher and author Dan Ariely.

In the first trial, Ariely offered study participants the choice of a:

- Web-only newspaper subscription for $59

- Print-only subscription for $125

As you might expect, 68% chose the cheaper web-only option.

But in the next trial, Ariely gave participants a choice of three subscription options:

- Web-only for $59

- Print-only for $125

- Web and print for $125

When this third option of having a web and print subscription was introduced, only 16% chose the cheaper web-only choice (compared to the 68% who picked this in the first trial).

A staggering 84% opted for the web and print subscription combo even though it was priced as expensive as the print-only version they clearly turned down in the first trial.

So why did this happen?

Because the print-only subscription was the decoy. It nudged people to buy the web and print combination because they believed they were getting more for the same price.

Check out this live Wall Street Journal example below:

The first two offers serve as the decoys that nudge people towards taking the ‘Best Value’ third option which, while you get the discount longer, you also pay for the service longer, which is exactly what they want people to do.

So if you have a specific product that you want to guide your customers into buying, decoy pricing may be the right strategy for your business to take.

4. Price Appearance

Price appearance is a tactic where you change how your price looks to encourage people to buy. This pricing strategy is all about shaping your customer perceived value (CPV), which we touched on earlier.

CPV is what your customers think they stand to gain when purchasing from your brand compared to the price they have to pay for it. So to use price appearance to your advantage:

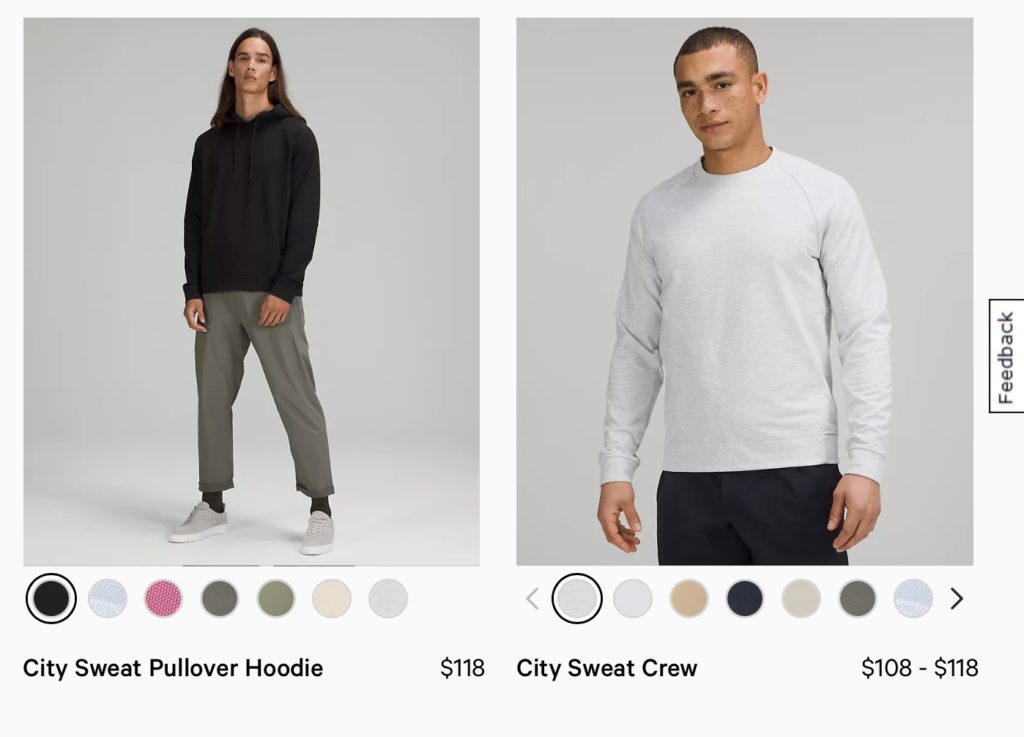

Keep your prices short if you want to convey a deal to your customers. Shorter prices are seen as less expensive, while longer price tags, which take more time to read in the minds of consumers, are seen as more expensive.

Even the number of syllables in a price can increase or decrease how big or small the price tag seems to buyers. And if you’re really hoping to capitalize on having the lowest price, ditch the dollar sign before your price altogether.

Changing the font size of your price tags has a similar effect. If you want to convey a big discount, for example, make the discount font size larger than the original price tag. Your customers will subconsciously view it as a bigger deal.

These minor price tweaks are likely to go unnoticed by your customers, but they can change their perceptions entirely. That’s the power of using psychology in your pricing.

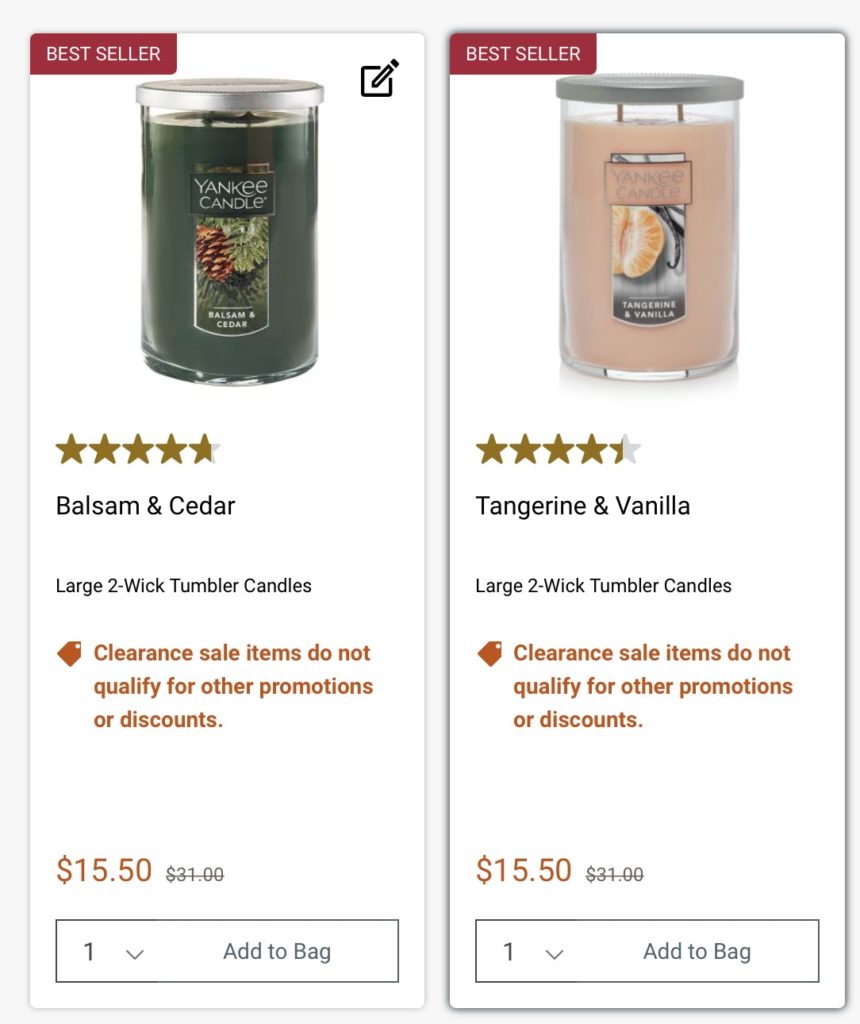

5. Price Anchoring

Price anchoring is when you establish a base price as an anchor to compare your lower- or higher-priced items to.

In the example we just mentioned (and as seen in the image below), the original price of an item is often listed much smaller than the discounted price. So the initial price serves as the “anchor” that buyers will compare the discount price to. Because there’s a clear difference in font size, the discount seems much bigger and more enticing.

You can also find more great examples of price anchoring at car dealerships.

The dealer offers several models of the same car, each with different features, upgrades, and prices. The sales rep will compare both the lower base and premium model pricing (the anchors) to the models buyers are considering. This shows them just how many features they can get for a slight price increase.

Price anchoring works well when you want to highlight discounts. It’s also especially useful for companies that offer multiple tiers of their products, similar to the next pricing strategy.

6. Center Stage

The center stage pricing strategy relies on the fact that people notice products placed in the middle of a set of options more than the others in the lineup.

Our eyes are naturally drawn to the center, just like we pay more attention to the actor taking center stage or an artist standing in the middle of their backup singers. So the center makes the perfect place to put the product you want customers to buy on full display.

You can also combine the center stage strategy with decoy pricing to easily double your impact and sales.

In this case, you could have the less expensive option to the left and the highest-priced choice to the right of the one you want customers to notice. The two products on either side become decoys to simply nudge people toward the one in the middle.

7. Innumeracy

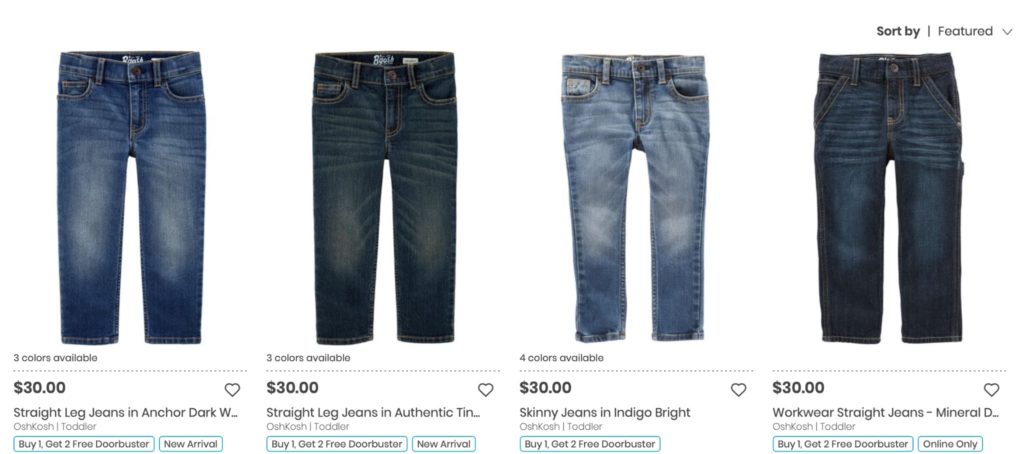

Innumeracy is defined as a lack of understanding when it comes to numbers and calculations. And though that seems harsh, your business can use your customers’ dislike of math to its advantage.

Case in point: the popular “buy one, get one free” or BOGO deal (or this crazy incentive pictured below, which is buy one get two free).

Customers love BOGOs. Yet, it wouldn’t be as well received if you were to offer a “buy two at half off” deal, which is essentially the same discount.

That’s the pricing strategy of innumeracy at work.

To consumers, it feels like they’re getting an entire item for free with a BOGO, even if they’re technically paying 50% less for two of your products. Again, it’s all about the perceived value, and it works like a charm.

Start Testing These Psychological Pricing Strategies Today

Adding psychology to your pricing strategy can nudge customers to take action, help you drive more sales, and improve your CPV. But if you don’t keep your target buyers in mind or use these tactics strategically, they could have the opposite effect.

So take a minute to brainstorm why you want to use psychological pricing (i.e., to convey a steep discount, raise perceived value, etc.), then determine which of today’s strategies best suits your goals.